Current Price Level of SST Systems

Currently, SST products are in the early stages of development. There is significant variation in solutions and technical routes among both overseas and domestic suppliers. The widely accepted average value per watt is between 4 to 5 RMB. Taking a typical 2.4 MW SST configuration as an example, at 5 RMB per watt, the total system value could reach 8 million to 10 million RMB. This estimate is based on pilot projects in data centers in the U.S. and Europe (such as those by Eaton, Delta, Vertiv, and other major joint ventures), reflecting the context of prototype units during the R&D phase and an unstable upstream supply chain.

Value Distribution Across SST System Components

Assuming a value of 5 RMB per watt, the system can be divided into five major modules with the following breakdown:

Rectifier Module: 40–50% share, ~2 RMB/W. Includes power semiconductors such as SiC, GaN, or IGBT-based solutions.

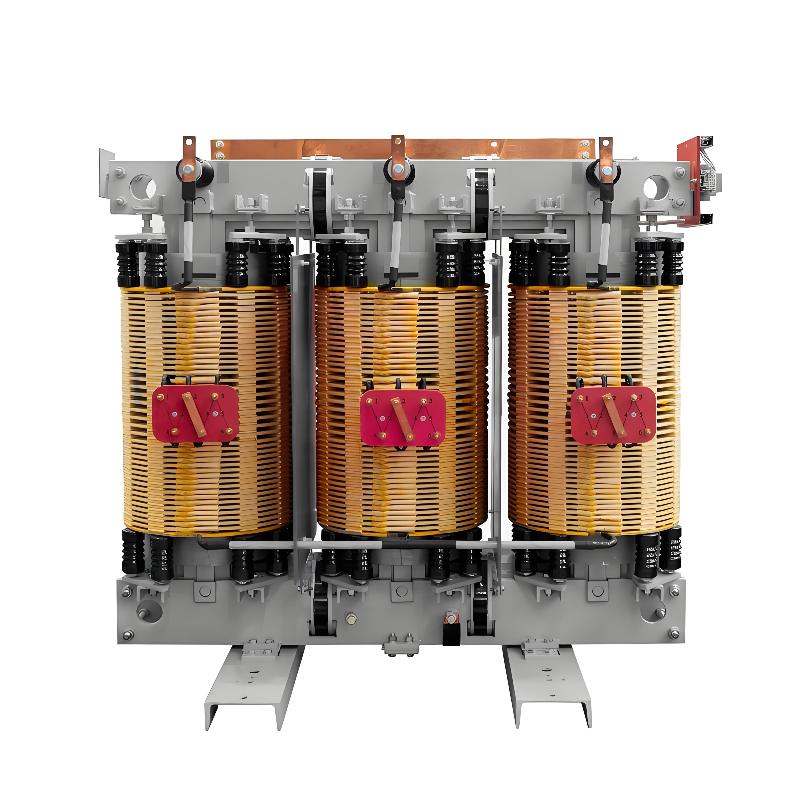

High-Frequency Transformer: ~25%, ~1.5 RMB/W. Requires amorphous materials to meet high permeability, low loss, and thermal stability requirements.

Control & Power Distribution: ~15%. Includes 800V DC switchgear (conventional or future solid-state switches) and distribution panels.

Energy Storage (Supercapacitors & BBU): ~11%.

Cabinet Structure & Cooling System: ~8%.

Future Trends in SST Pricing and Domestic vs. Overseas Price Differences

The trend for SST value is expected to decline rapidly and significantly. Many Chinese companies (e.g., Jinpan, Sungrow, and component-originated firms) have entered this space. In the future, domestic prices are expected to approach the value level of Panama power systems. A 2.4 MW Panama power unit is valued at around 1.5 million RMB; it is projected that by 2030, mature domestic SST pricing will be around 2 million RMB. Some Chinese firms anticipate volume deployment by 2027–2028, while companies like Schneider are also developing SSTs, likely reaching mass production around 2030.

In North America, prices are expected to be at least 4–5 times higher than in China. A 20–30% price drop may occur by 2027–2028, but due to supply chain constraints, tariffs, and market competition structure, the price war will not be as intense as in China.

North American Characteristics in SST Technical Routes

North America pays less attention to existing solutions and is exploring 35 kV and 20 kV SST configurations, as higher voltages offer greater benefits for renewable integration and efficiency optimization. The technical direction favors 35 kV and 20 kV input voltages. Higher medium-voltage levels significantly impact overall system value. Additionally, North American system voltage is 13.8 kV, compared to 10 kV in China, leading to differentiated design of medium-voltage components. Equipment and parts compliant with U.S. standards differ substantially from those used domestically.

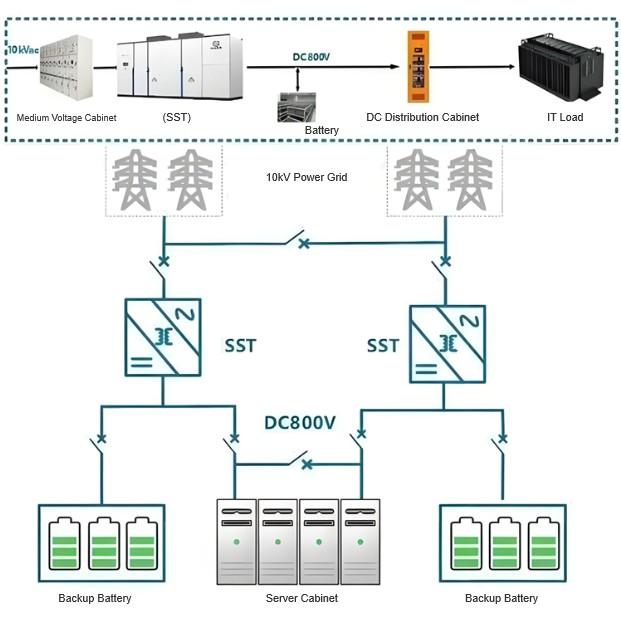

SST Configuration Characteristics for Data Centers

In China, a 2.4 MW prototype is typically used for estimation, whereas in North America, 3.5 MW is often the standard—driven by differences in system voltage and power levels. For a data center with a 2.4 MW IT load, two SST units should be deployed, following a 2N redundancy design.

Are Domestic and Overseas SST Markets Fundamentally Different? What Challenges Do Chinese Companies Face Going Global?

From a product and application perspective, there are fundamental differences between domestic and overseas SST products—similar to gray-zone power equipment in data centers (e.g., circuit breaker insulation performance, better sealing and higher cooling requirements in North American cabinets, transformer efficiency differences). These factors will influence the future evolution of SST technology.

Chinese companies face no major barriers going global, but they must conduct early research on relevant standards, obtain certifications, and align with the needs of power system integrators that match upstream and operator requirements.

Is China’s HVDC and SST Development Slower Than North America’s? What Are the Opportunities for Chinese Companies Going Abroad?

From a practical standpoint, the rate of increase in rack power in China is not as urgent as in North America. Top-tier GPU supply is limited in China, and local vendors focus more on demands from Tencent and Alibaba. However, gray-zone power equipment does not hinder Chinese companies from expanding overseas.

Going global presents incremental opportunities. Focusing solely on the domestic market risks falling into cutthroat competition. Chinese firms can become part of the SST supply chain by exporting basic components, supplying high-frequency transformers or rectifier modules, and conducting R&D on equivalent load racks—where restrictions are less stringent than for GPUs.

Which Chinese Companies Could Interface with NVIDIA Like Eaton or Delta?

Integrated players such as Jinpan and Sungrow have a higher chance of entering the SST supply chain, as cloud providers have limited internal expertise in power systems and will likely demand comprehensive system integration capabilities from suppliers.

Who Holds the Product Definition Power in SST?

The current situation is unique. The 800V white paper was released by NVIDIA, making alternative solutions like ±400V appear niche. Since GPU roadmaps are controlled by NVIDIA, its influence over SST is strong, and it can lock in shortlisted suppliers. However, if Google, Microsoft, or others pursue differentiated paths, they may jointly develop distinct technical routes with companies like ABB or Schneider. Currently, development is largely influenced by NVIDIA.

What Are the High-Barrier Technologies in SST?

Two key areas:

Solid-State Switches: SST requires millisecond-level response speed. Traditional low-voltage or DC switches cannot meet single-digit millisecond requirements. Domestic companies like Chint (Lingtai) and Zhengtai have prior research and applications in telecom fields, giving them potential entry opportunities.

Supercapacitors: Critical for short-term energy buffering with millisecond response—another key technological direction.

Other components are mostly integrated with rectifiers and high-frequency transformers, with relatively minor differentiation or difficulty.

Which Overseas Companies Excel in Solid-State Switches?

Leading overseas players in solid-state switches include Siemens and Schneider. Chint (Lingtai) has specialized expertise in certain types of circuit breakers.

Gaps Between Chinese and Global Leaders (e.g., Delta, Schneider, Eaton) in SST Integration? How Can Chinese Firms Enter Global Supply Chains?

Global leaders have full coverage across all segments. When integrating SST systems, they hold clear advantages in ecosystem, product R&D, integration capability, and business acquisition.

Domestic firms perform well in individual modules but rarely match companies like Siemens or Schneider, which cover low-, medium-, and high-voltage, and generation sectors comprehensively. Under profit-driven and scale-effect models, Chinese firms may lag slightly in niche applications.

More realistically, Chinese companies may enter the supply chains of Eaton, Schneider, or Vertiv as OEM/ODM partners, indirectly supplying the NVIDIA ecosystem. Independent entry into primary supplier lists remains immature. Once global players mature technologically and secure market share, Chinese firms may gain opportunities for private labeling and subcontracting.

Which Chinese Companies Can Provide Foundational Support for Overseas SST Deployment?

Jinpan and Sungrow are relatively leading. Jinpan has a factory in the U.S., and its brand has good penetration in North America. Additionally, Eagle Industries is building a plant in Mexico—having local manufacturing provides significant advantages in after-sales and maintenance support.

Why Can Chinese SST Prices Be Lowered? Is It Due to Lower Requirements for Certain Modules?

From the perspective of foreign brands, large price gaps between domestic and overseas markets for new products are common. For example, a typical high-voltage inverter costs about 200,000 RMB in China, but 800,000–1,000,000 RMB overseas—a difference of nearly 4–5x. Given that HV inverters and SSTs share similar components (rectifiers, HF transformers) and emphasize customization, a similar price gap is expected for SSTs.

The lower price of Chinese SSTs is not because requirements for medium-voltage HF transformers or HVDC modules are lower, but rather due to domestic competitive environment, industrial chain maturity, and historical pricing trends. Future factors like technological maturity and demand may influence the gap—possibly narrowing it over time.